Course Overview

Finance is often described as the language of business. For executives and professionals without a finance background, understanding this language is critical for making informed decisions, evaluating opportunities, and contributing to organizational success.

This practical, executive-level program demystifies financial concepts and focuses on what truly matters in business: creating and sustaining value. Participants will learn to interpret financial statements, assess business performance, evaluate investment decisions, understand financing choices, and connect strategy to shareholder value. Through real-world cases and interactive exercises, this course bridges the gap between financial theory and business practice.

Learning Objectives

By the end of this program, participants will be able to:

- Understand the role of finance in value creation and decision-

- Interpret financial statements as a business story, not just

- Analyze performance drivers: profitability, growth, cash flow, and working

- Assess financing choices (debt equity) and their impact on risk and shareholder value.

- Apply basic investment appraisal tools (NPV, IRR, payback) to evaluate

- Use modern budgeting and forecasting methods to align with

- Grasp the fundamentals of business valuation and how markets perceive

- Communicate financial insights effectively to boards, investors, and

Learning Methodologies

The program uses a highly interactive approach tailored for non-finance executives, combining:

- Instructor-led discussions

- Case studies & group

- Simulations & role-

- Interactive

- Executive-level debates

Who Should Attend

This program is designed for professionals and executives who do not have a formal finance background but are required to make or influence financial decisions, including:

- Senior managers and department heads in non-financial roles (marketing, operations, HR, IT, supply chain, etc.)

- Entrepreneurs and business owners who want to strengthen financial decision-

- Board members and advisors seeking to understand financial discussions at the strategic level.

- Professionals transitioning into leadership roles where financial acumen is

Program Fees:

PKR 30,000 (Exclusive of Tax)

Application Deadline:

April, 2026

Classes from:

April, 2026

Duration:

16 Hours (2 Days)

Venue

EMEC, IoBM

Registration

Course Outline

- The role of financial management in decision-making

- The purpose of financial management accounting

- Accounting principles & policies (practical overview, not technical IFRS deep dive)

- The executive’s role in corporate governance

- From Profit to Enterprise Value: what drives value (profitability, growth, risk, capital structure)

Objective: Go beyond reading numbers to understanding performance drivers.

- The three statements simplified: Balance Sheet, Income Statement, Cash Flow

- How business activities flow through the statements (cash accrual)

- The critical link: Why profit ≠ cash

- Evaluating performance: liquidity, profitability, efficiency

- Cash Flow & Free Cash Flow as decision tools

- Working capital as a strategic lever (cash conversion cycle)

- Benchmarking & spotting early warning signals

Activity: Competitive Diagnosis

Analyze one company vs. two competitors and present who is better positioned and why.

Objective: Understand how financing decisions affect risk, growth, and value.

- Why businesses need financing: growth, stability, and flexibility

- Debt equity, short vs. long-term financing

- The cost of capital: debt, equity (CAPM intuition), and WACC as the hurdle rate

- Strategic financing options: acquisitions, partnerships, divestments, restructuring (simplified overview)

Activity: The Boardroom Dilemma

Debate financing strategies for a project, assess debt vs. equity mix, and justify hurdle rates based on risk appetite

Objective: Learn how to evaluate investments strategically.

- The capital investment (CAPEX) process: idea to approval

- Simple tools: Payback and ARR (with limitations)

- The Time Value of Money in plain terms

- Discounted Cash Flow methods: NPV (“value created”) and IRR (“break-even return”)

- Strategic financial evaluation — why bold projects sometimes win and safe ones lose

Activity: Investment Appraisal Case

Compare Project A vs. Project B; decide which creates more value (simplified decision case, not full calculations).

Objective: Learn how to plan and adapt in today’s volatile environment.

- Why organizations budget: alignment, accountability, decision support

- Traditional modern approaches: rolling forecasts, driver-based planning, ZBB, Beyond Budgeting

- Linking forecasts to short-term and long-term goals

- Using “what-if” analysis and stress testing for resilience

- Variance analysis as a performance management tool

Activity: Budget Redesign

Transform a static annual budget into a rolling, driver-based forecast using Balanced Scorecard principles.

Objective: Connect financial tools to value creation and communication.

- The essence of valuation: cash flows, growth, and risk

- Simplified methods: Multiples (P/E, EV/EBITDA) DCF

- Why market value ≠ management view (bridging perception gaps)

- Linking strategy to shareholder value: capital allocation, growth choices, and long-term positioning

- Communicating value: telling a compelling story to boards, investors, and employees

Program Benefits

Participants will leave the program with the ability to:

- Speak the language of finance

- Engage in financial discussions with peers, boards, and

- Make better strategic and operational decisions using financial

Strengthen their contribution to sustainable value creation in their organizations

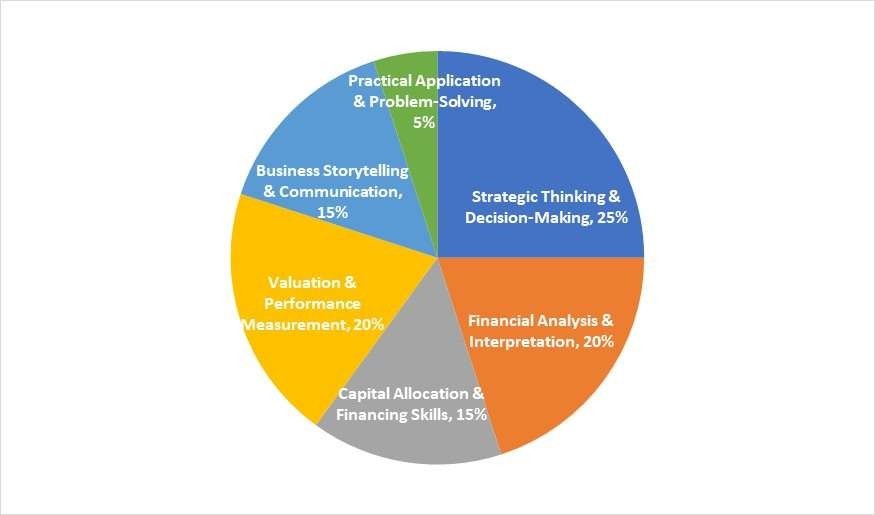

Key Competencies Developed

Program Fees:

PKR 30,000 (Exclusive of Tax)

Application Deadline:

November 20, 2025

Classes from:

Friday, November 21 & Saturday, November 22, 2025

Duration:

16 Hours (2 Days)

Venue

EMEC, IoBM

Registration

Trainer Profile

Shahid Ilyas

FCMA, CIMA (UK), MBA (IBA)

Shahid Ilyas is a strategic finance leader and corporate trainer with 22+ years of experience across multinational corporations, advisory roles, and academia.

A Chartered Management Accountant (CIMA–UK), Fellow of ICMA International, and

MBA graduate from IBA Karachi, he blends financial expertise with strategic insight to help organizations strengthen decision-making, governance, and long-term value creation.

Shahid spent over a decade at Schneider Electric, a Fortune 500 company, as Head of Finance, where he supported leadership teams in shaping strategic decisions on growth, investments, and business transformation. Today, he serves as CEO of LearningCrest, Strategic Advisor to a diversified business group, and Assistant Professor (Adjunct) at SZABIST University.

Shahid Ilyas is a strategic finance leader and corporate trainer with over 22 years of experience across multinational corporations, advisory roles, and academia. A Chartered Management Accountant (CIMA–UK), Fellow of ICMA International, and MBA graduate from IBA Karachi, he integrates financial expertise with strategic insight to help organizations enhance decision-making, governance, and long- term value creation.

Internationally trained in governance, finance, leadership, and project management across Asia and the Middle East, Shahid brings a global perspective to his work. He also serves on the Evaluation Committee for the Best Corporate & Sustainability Report Awards, reflecting his commitment to advancing corporate excellence in Pakistan.